Non-fungible tokens (NFTs) have exploded in popularity since 2020, from just under $14 million in sales. That’s between January and June of 2020 to $2.5 billion during the first half of 2021. Looking at these numbers, it is easy to understand why some investors are ready to spend thousands, if not millions, on a single NFT.

NFT was named Collins Dictionary’s Word of the Year for 2021, prompting even more people to inquire what NFTs are. Here’s what you need to know about this strange phenomenon.

What are Non-Fungible Tokens?

Non-fungible tokens, or NFTs, are an implementation of blockchain technology that allows them to be differentiated from each other. They can represent unique items with distinct attributes. Because they’re on the blockchain, these tokens are immutable and provably scarce. This makes it possible for them to have value in digital economies by being tradeable or collectible items.

What Do We Mean by Fungible Vs Non-fungible?

When something is fungible, it means that it can be replaced with an item of equal value. For example, two $1 bills are considered fungible because they have the same financial value even though one might have a different serial number than the other.

Non-fungible tokens on the other hand are not replaceable, they represent unique items that cannot be traded with another one. For example, you can’t trade a house for another one of equal value because each house is different in some way.

How Do NFTs Work?

Like cryptocurrencies, you can trade NFTs on specialized platforms such as OpenSea. A sale does not always imply the transfer of the token’s described object. For example, NFTs of well-known paintings have been sold, but the buyer does not receive the picture. The certificate of ownership of the NFT, which is registered on the blockchain, is what changes hands. The certificate must be stored in a digital wallet, which can come in a variety of formats.

NFTs work by utilizing smart contracts to ensure the token holder receives their item after it is purchased or otherwise traded.

An owner of an NFT might want to sell it, either immediately or in the future, but there are few options available currently that offer completely trustless peer-to-peer trading. The most common method is through auction-style listings where potential buyers bid on the item.

Once a buyer has been determined they’ll send their funds to the seller who then sends their item directly to the buyer. While this method works most of the time, sometimes disputes arise about whether or not items were accurately represented during the listing or after they had been sent.

Most auction-style listings require the use of MetaMask which makes trading for NFTs unnecessarily complicated and can limit its user base to those who already own Ether. To acquire an NFT, the wallet must have adequate ether (ETH).

If you plan to regularly make transactions with various cryptocurrencies to acquire NFTs, then you might want to consider accounting software that can keep up with the changes in technology.

Characteristics of NFTs

The key characteristics of an NFT include:

1. Indestructible:

The token cannot be destroyed or hacked.

2. Unique:

Each token is different from any other token, even those of the same object.

3. Fungible:

Similar to cryptocurrencies, NFTs can be traded and exchanged for others. This makes them fungible as well.

4. Immutable:

Since they are on a blockchain, once issued these tokens cannot be changed or deleted.

5. Provenance:

Tracked ownership of the item which provides a history of its transactions and changes of ownership over time using cryptographic primitives such as public keys and hashes that identify all transactions pertaining to an NFT owned by a specific address.

6. Limited Supply:

There will only ever be a certain number of tokens in existence. The total number can be programmed into the token itself.

7. Transferable:

Tokens can transfer from one user to another through a digital wallet or sending software solution such as Metamask.

8. Digital Identity:

Every transaction is tied to a unique identity, called a cryptographic identifier, which cannot be separated from the item it represents by any means short of destroying it entirely. This is done using public-key cryptography where only the owner of their private key will have access to them even when they are on an open ledger like Ethereum’s blockchain. When owners want to use their tokens in transactions they prove ownership by signing with their private keys so that no one else can access it except for the person they exchanged value with if they so choose.

9. Verifiable Ownership:

Once an NFT is created it cannot be forged or taken away by anyone else unless they gain access to the owner’s private key which would allow them to prove ownership of the token in question.

10. Tracked Transactions:

Every time an NFT changes hands, either because it was purchased or sold, there is a verified record of that transaction. This is done using public-key cryptography to sign transactions with their private keys and then publishing signed transactions on the Ethereum blockchain where all users can see whether or not each transaction has been authenticated by its owners based on who controls their cryptographic identifiers (public keys).

How Is an NFT Different from Cryptocurrency?

NFTs are exclusively digital, whereas cryptocurrencies represent any sovereign currency recorded on the blockchain.

For example, Ether is a cryptocurrency because its value is tied to the US dollar and fluctuates according to market forces whereas Non-Fungible tokens do not have value except for what their owners assign them.

Additionally, NFTs are specific to each blockchain which means that they can only be traded on that particular platform’s ecosystem. For example, if you buy one NFT on Ethereum it cannot be transferred to the EOS blockchain without having first been converted into an EOS token first.

What Can You Do with NFTs?

NFT’s have a wide variety of potential uses including:

Escrow Services

Consumers and sellers alike use escrow services when making trades in person or online. The buyer sends their funds to an address controlled by the escrow company – in the case of NFTs, this would be a smart contract. Once both parties agree that the items have been sent or received, the money is automatically transferred to either one of them without any middleman needed. This eliminates fraud from third-party brokers who often charge high fees for providing these types of services.

Digital Collectibles

Another common use case is digital collectibles. These are items that can be collected or traded that hold value because they are rare. Think CryptoKitties! There could be all kinds of digital assets represented by NFTs including rare artwork, trading cards, game items, etc.

Decentralized Marketplaces

This is also one of 0x protocol’s use cases since it allows anyone to create a trustless marketplace for NFT traders to find each other and trade directly within their platform without any third party involved. If you own an NFT it doesn’t matter where the buyer lives because you can send your item via mail using USPS or FedEx if necessary.

Gaming Tokens

Many games today already utilize virtual currencies like Riot Points or WoW gold, but it’s difficult to trade these items with other players outside of that game. NFTs are used to create in-game currencies which you can trade for other game assets, making it easier than ever before to amass a collection of rare items and sell them on the open market.

Popular NFT Marketplaces

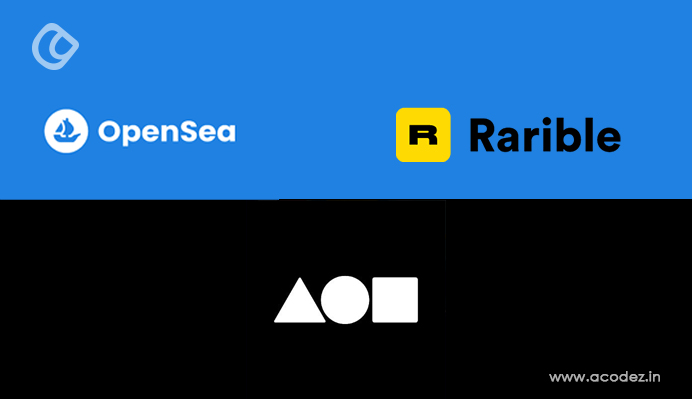

The most popular NFT marketplaces at the moment are:

OpenSea.io: This peer-to-peer network offers uncommon digital items and collectibles. To begin, all you have to do is register an account on the site and explore the available NFT collections. You may also sort pieces by sales volume and start your journey to discovering new artists.

Rarible: Rarible is a popular, democratic, and open marketplace that allows artists and creators to issue and sell NFTs. Holders of RARI tokens have the ability to influence aspects like fees and community standards on the platform.

Foundation: On this platform, artists must get “upvotes” or an invitation from fellow creators to post their work on this platform. The community’s high cost of entry — artists must buy “gas” to mint NFTs — and its exclusivity, suggest that it may contain higher-quality art.

What are the Risks?

While NFTs have a lot of potential, they are still a new technology with a lot of caveats. For example, many games store their items in so-called “centralized databases”. It can be vulnerable to server hacks that could result in stolen or deleted assets. This is why it’s important for players to hold onto their private keys when storing these kinds of digital assets. Specially since it’s outside of trusted third-party servers.

But at least one blockchain project has been making progress on this front. It’s by creating a decentralized marketplace specifically designed for the virtual asset economy. Called Decentraland, this project launched its own ERC20 token MANA and built its entire ecosystem around it – including buying parcels of virtual land where users can build applications and trade NFTs.

One additional risk that is unique to NFTs is that it can be hard to tell what you’re buying when purchasing one off from an individual. Especially in the case of digital collectibles like CryptoKitties. Because there’s no centralized database containing information about each NFT, it’s up to the seller to accurately describe their asset and prove its authenticity. This means any deal you strike with someone else will rely on your trust in them. So it is important to only buy from reputable sources if possible.

Conclusion

Non-fungible tokens are a new kind of cryptographic asset which gives developers more ways to store data on the blockchain. Blockchain technology will help the adoption of this exciting new technology by providing more consumer protection while also reducing costs. Every new NFT can represent a unique digital collectible while some may even serve as a ticket to some type of in-game experience or a physical asset like a piece of art or guitar.

Although NFTs are being utilized by games like CryptoKitties and Decentraland as well as by decentralized marketplaces like OpenSea.io, Rarible, and Foundation to name a few. As the space matures you can expect to see continued growth in overall token value and network usage as more industries and institutions begin adopting them for their own uses cases.

The team at Acodez always try to keep themselves updated with the new trends. Acodez is one of the leading web development company in India. With the experience of more than 10 years and a client base of more than 1000, we’re all set to cater to your custom web development requirement. Apart from that we are one of the most prominent digital marketing agency in India. Contact us now!

Looking for a good team

for your next project?

Contact us and we'll give you a preliminary free consultation

on the web & mobile strategy that'd suit your needs best.